Thursday, February 19, 2009

What Does "Create or Save" Jobs Really Mean??

"Green Payments" in Agriculture

- Current payments are related to factors such as farm size, crops, etc., that lead to a certain distribution of these payments across the country. Land values, equipment loans, etc., are tied to the existence of those payments. Changing payments to be based on environmental amenities is likely to result in a distribution of payments that is at least somewhat different than the current distribution, which could have impacts on land values, cropping patterns, etc. Do we understand this process well enough? Are we ready to accept the consequences of those changes?

- Green payments are presumably not tied to farm revenue, prices, production, or any other historical variable related to the farm. As such, the revenue these payments would provide are not counter-cyclical to farm revenue. Do we care if farm policy does not provide income risk protection?

Some Clear Explanations...

Wednesday, February 18, 2009

"Executive" Pay Caps in Wonderland...

Some "Better" Housing News...

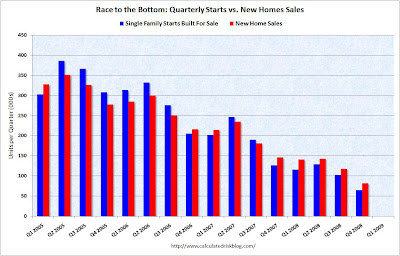

The red bars show quarterly new home sales and the blue bars is quarterly housing starts. Note that 2006-most of 2007, starts exceeded purchases, which implies growing inventories. But, during 2008, purchases exceeded starts, which signals a draw down in inventories. This is relative, of course, because both are racing to the bottom right now...but, maybe we will bleed off inventories enough to start to stabilize price.

The FED Provides More Bleak News...

Their projections show a return to positive growth in 2010, with a spike in unemployment of around 9%. Let's hope they are not being too optimistic.

More Peanut Business...

Capacity Utilization...

Industrial capacity is being idled at a quick pace. Although we have not reached levels of the 80s, we are getting there quickly. Note, however, that this is somewhat of a lagging indicator because it bottoms out after a recession has passed...the draw down in inventories occurs prior to the restart of production, which is why I favor watching inventories more than industrial capacity utilization numbers.

Asian Unemployment

Inventories...

Tuesday, February 17, 2009

Some more perspective on the 'crisis'

The gray line is the crash of 1929, green the tech crash, red the oil crisis, and blue the current bear market (all but the 1929 data are S&P 500 data; the 1929 is based on the DOW). Note that we are percentage decreases in the market consistent with the tech and oil crashes, but in much shorter time frames. Interestingly, the oil crisis was a "classic V" with a final dip to a bottom and then a recovery. The tech crash has a "double V" pattern with a test of the 50% level twice before recovery. This does not mean much except that we have tested the 50% decline once and are close to that level again. What happens next is anyone's guess...but let's hope it is not cliff diving.

Rush to Wait...

The big story last week was the incredible Congressional rush to pass a bill that was more than a thousand pages long in just two days-- after which it sat on the President's desk for three days while the Obamas were away on a holiday.

There is the same complete inconsistency in the bill itself. Despite the urgency in President Obama's rhetoric, as well as in Congress' haste in passing a bill which few-- if any-- members had time to read, much less consider, most of the actual spending will take place next year, at the earliest.

The Dangers of Protectionist Sentiments...

Measures in a $789 billion U.S. stimulus package that favor American goods are a "poison" that will hurt efforts solve the financial crisis, an editorial by China's official news agency said.Protectionism is a problem that can spiral into outright trade wars. Waves of protectionist policies pervaded the world in the lead-up to World War II. We are not there yet, but protectionism is a popular political subject because of the perceived need to "protect our people" in times of economic hardship. Keep your eyes open on this one...Provisions in the U.S. stimulus bill approved Friday favoring American steel, iron and manufactured goods for government projects are protectionist measures that could trigger trade disputes, said the editorial issued late Saturday by the Xinhua News Agency.

"History and economics have told us, facing a global financial crisis, trade protectionism is not a solution, but a poison to the solution," the editorial said.

European Exceptionalism and Trade Policy

Executive Pay Caps...

Monday, February 16, 2009

Cattle Industry Needs to Adapt...

More Economic Downturn Ruminating

Income Elasticity of Demand...High End Autos

Politics Matters Too...

Here is an illustration of how politics affects economic outcomes by changing the "rules of the game." Ultimately, politicians are not so much concerned about correct courses of action as reelection. This is not to say they are nefarious...just looking out for their own interests. This is an important lesson for both amateur and professional economists. For the amateur, don't forget that economics must operate in a political world. For professional economists...ditto.Early in the hearing, Mr. Frank urged all lenders not to foreclose on any mortgage borrowers until Treasury Secretary Timothy Geithner unveils a new foreclosure mitigation plan. In fact, foreclosures had already started to decline due to Treasury-created uncertainty. Mr. Frank's admonition will cause a more rapid fall, since Citigroup, Bank of America and J.P. Morgan "volunteered" to a temporary freeze after the hearing.

Don't confuse this with a sign that the housing market is improving. The pols are simply delaying the pain until they decide how much to inflict on taxpayers versus investors. It's true that investors in consumer debt can expect subsidized financing from Mr. Geithner, but it's a flip of the coin whether the new subsidies will outweigh the costs of new foreclosure limits. (My emphasis added)

Treasury Yields Rise...Duh...

Bank 'Nationalization'

Some more perspective on the 'crisis'

Note the number of failures now compared with the number of failures in the 1980s...perhaps declaring this as "the worst crisis since the Great Depression" is a bit premature. In terms of banking, the 1980s was much worse than the Depression, and we have not even approached the numbers of the depression. But, wait...what about the value of assets:

Note the number of failures now compared with the number of failures in the 1980s...perhaps declaring this as "the worst crisis since the Great Depression" is a bit premature. In terms of banking, the 1980s was much worse than the Depression, and we have not even approached the numbers of the depression. But, wait...what about the value of assets: This figure appears to indicate that we are, in fact, closing down more value (in terms of assets) in the bank. But, most of the value of closings in 2008 is WaMu, which was closed and then sold to JP Morgan at no cost to the government. So, if you take out WaMu, we are still way below what was closed down in the 1980s. There will, no doubt, be more bank closings in the future...but let's keep it in perspective.

This figure appears to indicate that we are, in fact, closing down more value (in terms of assets) in the bank. But, most of the value of closings in 2008 is WaMu, which was closed and then sold to JP Morgan at no cost to the government. So, if you take out WaMu, we are still way below what was closed down in the 1980s. There will, no doubt, be more bank closings in the future...but let's keep it in perspective.